In Jason Rhoades’s latest POWERGRID International article, he explains why utility spending must managed carefully. Of course, it’s a nuanced situation with a number of variables in the equation. Check out his article to get a better understanding of the big picture.

There are obvious reasons why the utility industry differs from other segments of the economy. For starters, utilities don’t compete with one another, which makes sharing best practices not only easy but also a way of life. There are also less evident ones, especially for utility customers. Namely, utilities, in particular investor-owned power companies, earmark money they spend as either capital expenses or operations and maintenance dollars. Generally, investor-owned utilities borrow about 40 percent of their money from lending institutions and 60 percent from shareholders. Regardless of the source, the lender expects a return on the money.

In each state where a utility operates there is a public utilities commission regulating how much of a return the energy company can earn on investments. This varies by state. One commission may allow a 10 percent return, another state may set the return on the utility’s investment for capital at 9 percent. Whatever the amount, the utility must make an argument for how much work it wants to do and how much money it will spend to achieve a return. Contrary to what many utility customers think, the company isn’t stockpiling or re-investing the money. As customers pay for the electricity delivered to their home or business by the distribution system, the utility divvies up the payment for mortgages and leases on buildings, employee salaries, etc. Any surplus goes to shareholders and lending institutions in the form of dividends and payments on loans.

Capital vs. O&M spending

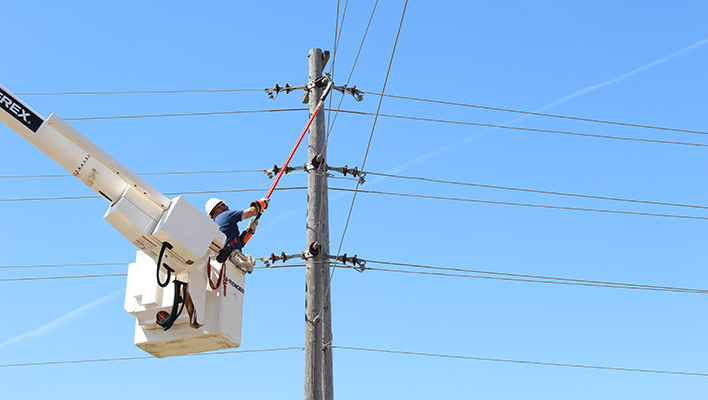

There’s no return on money that is tagged for O&M, so if a utility spends less O&M money than it budgeted for, the surplus goes to the customer. To illustrate the difference between capital expenses and O&M, consider the following. A utility purchases and puts in a new pole with a capital loan. The utility calculates the asset has a 40-year lifespan and charges customers 1/40th of the pole’s price annually until paid off. Regarding O&M spending, let’s say a driver skids off an icy road and breaks a pole. The utility taps its O&M money to replace the damaged pole for, say, a $1,000. With O&M, the utility pays the entire cost of replacing the broken pole in the year the break and repair happen.

Utilities try to keep O&M costs to a minimum, preferring to invest capital on projects that improve reliability, harden the grid, and bring a return for shareholders. Utilities also want to keep the customer’s bill flat and deliver a good experience.

It’s not uncommon for a utility to fail to recover the cost of damage to poles, and other assets, caused by third parties. In fact, every year, some utilities write off up to 70 percent of the cost of damage by third parties because there isn’t enough documentation to make a claim with the responsible party’s insurer. That documentation includes police reports, notes by crews making repairs, and a list of materials and hours worked. Without a record of what happened, who was at fault, and how many hours and how much material crews used, the cost of repair hits a utility’s O&M budget. Think of the hundreds of thousands, perhaps millions, of dollars lost annually because there’s no paperwork to recover costs.

Nobody likes paperwork, least of all line crews. And despite many utility workers considering undocumented work as just something the utility will “write off,” there’s no such thing. Someone must pay. Documenting damage is critical for assigning responsibility and cost to the appropriate party and protecting utility customers. One Midwest utility I know of has begun the work of replacing paperwork, phone calls, and emails with a “mobile workbench,” a digital hub that employees can use to efficiently document work. Here’s how it will work: Let’s say a driver hits and breaks a pole. A digital work order goes to a crew. Once the crew is on site, they fix the pole and use a mobile device like a tablet (or smartphone) to open a mobile application to tick off which materials they used and the hours they worked. Crew members can also snap a photo of the police report and attach that to their report. Once finished, the crew fires off the files to the back office to process a claim with the insurer.

Tracking work with a mobile workforce management system can also help crews and storeroom managers keep tabs on inventory. With a mobile, digitized process, storeroom managers and crews can open a mobile application to account for which assets, hardware, and tools crews take as they load up their truck and leave a service yard. Using a system that automatically tracks the assets, hardware and tools crews use helps storeroom managers trace the location of the asset and whether managers can charge the cost of the asset and work to capital or O&M. There’s a benefit to the customer, too. If the utility can account for what it’s spending on assets and crew time, managers can direct more money into the system.

As you can see, digitizing the requisition and construction process is a winning proposition for utility leadership and field workers.